- The Absolute Safest and Lowest Cost Mobile Way to Pay and Accept Payments -

- eMobile is the long awaited New third Payment Processing option, an Alternative to ACH and Credit or Debit Cards. -

Users simply download the app, register, link a checking or savings bank account from any bank and start paying for goods and services. Users are able to pay the business directly, in real time and/or they can load money into the digital wallet and spend from the wallet. Money inside of the digital wallet is also able to be transferred to your bank account. Because eMobile saves merchants money, merchants pass the savings along in the form of customer discounts and rewards.

You don’t have to qualify for a rewards credit card, pay interest and rack up credit card debt in order to receive rewards when you purchase goods and services! Go Card Free – Save Time, Money and Hassle.

To pay an invoice or to make a purchase simply scan the QR code generated by eMobile, enter your pin and click “pay”.

eMobile is the safest and most secure form of mobile payment. No more risk of credit card data being breached and stolen. Going Card Free means no more expired, lost or stolen credit or debit cards.

With eMobile you pay in real time from your bank account using a QR code, almost like with an electronic check, or eCheck, except Merchants don’t have to worry about bounced checks or chargebacks - every payment accepted through eMobile is 100% GUARANTEED to be Bounced Check and Chargeback Free!

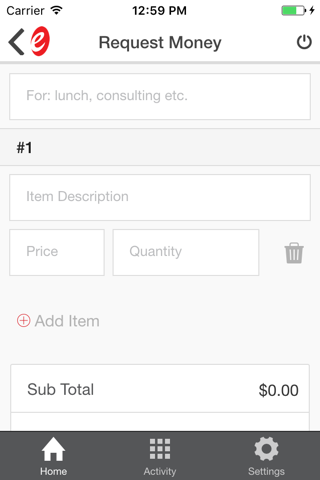

Businesses can accept eMobile easily - just sign up, verify your business, link your business checking and/or savings bank account and start taking payments or sending invoices. No terminals or swipers required. eMobile acts like a Mobile POS or Point of Sale system that can be used directly on your Phone or Tablet!

How much does it cost to accept payments with eMobile?

25 cents per Transaction. Guaranteed.

X No hidden fees

X No monthly fees

X No statement fees

X No interchange fees

X No terminal fees

X No Point of Sale / POS fees

* Just one Low Cost 25 cent Flat Rate per Transaction

Small & Medium Sized Businesses especially benefit from using eMobile by finally having an alternative to credit and debit card processing. Having an alternative to credit and debit card processing allows businesses to save more of their hard earned money and re-invest their money into things that will help grow their business and create more jobs.

Imagine:

ABC Plumbing has 5 plumbers visiting an average of 6 clients each per day. This makes a daily total of 30 transactions at an average of $275 each. At a typical 3.25% credit and debit card processing rate this would cost them $268 per day in credit and debit card merchant processing fees. Using eMobile instead would only cost $7.50. Each plumber could simply generate a QR Code invoice when the customer is ready to pay then send the QR code to the customer, or let them scan the QR code directly from their phone or tablet.

ABC Plumbing would save $92,478 in credit and debit card processing fees per year by using eMobile instead.

With $92,478 saved each year ABC Plumbing could hire another plumber and grow the size of their business!

Contact: eMobile | [email protected] | 844-693-2432 for questions, comments or requests.